Health protections is vital however can display a money related strain, with month to month premiums from an Reasonable Care Act (ACA) arrange for an person averaging $477.1

However, your costs may be higher or lower depending on both variables you can’t alter (such as your age) and a few variables you might have control over (such as your chosen scope level or which health protections company you select). If you are qualified for an boss or government arrange, your month to month costs ought to be distant lower than if you have to bear all the costs yourself.

Learn more around health protections costs underneath.

Contents

- 1 Key Takeaways

- 2 What Is Health Insurance?

- 3 How Much Does Health Protections Taken a toll Per Month?

- 4 Average month to month premium for one individual, adjusted to the closest dollar

- 5 How Much Does Health Protections Taken a toll by Age?

- 6 How Much Does Health Protections Fetched by Arrange Type?

- 7 How Much Does Health Protections Fetched Per Company?

- 8 How Much Is Health Protections by Metal Tier?

- 9 Average Taken a toll of Health Protections by State

- 10 Average Taken a toll of Healthcare by Family Size

- 11 Factors Impacting Health Protections Costs

- 12 Add up to Costs for Health Protections

- 13 How to Purchase Health Insurance

- 14 Alternatives to Health Insurance

- 15 Frequently Inquired Questions (FAQs)

- 16 The Foot Line

Key Takeaways

- Health protections costs depend on how you get your scope and such components as age, protections company, family estimate, where you live, Reasonable Care Act (ACA) metal level, and arrange type.

- Individual month to month protections costs extend broadly, from $12 for TRICARE to $1,758.16 for a 60-year-old on a platinum ACA plan.

- For ACA plans, month to month premium costs increment with age, family measure, and metal level. Premiums are moreover higher if you smoke or select a arrange with more supplier choices (such as a PPO).

What Is Health Insurance?

Health protections makes a difference you mostly cover the taken a toll of your therapeutic care in trade for a month to month premium or installment. Concurring to a 2023 Census overview, 92% of Americans had health protections at a few point amid the year.

Read:Understanding Health Insurance: Your Essential GuideEmployer-provided health protections covers 55% of the safety net provider populace. Ten percent have a arrange acquired from a private company, or through the ACA Commercial center or a state health protections trade. Around 36% of the populace has health protections through the government, including:

- 19% on Medicaid

- 19% on Medicare

- 2% on TRICARE, which covers dynamic military benefit individuals and their families

- 1% on VA and CHAMPVA, which covers veterans and their family members

How Much Does Health Protections Taken a toll Per Month?

Average Single Scope Premium/Month

Employer plan $116

ACA plan $477

TRICARE $12

Medicare Portion B $175

Medicare Advantage $19

One of the most critical components affecting the fetched of your health protections is where you get it. An ACA arrange acquired on the healthcare trade is for the most part distant more costly than a arrange you get through your boss or a government program such as Medicare or Medicaid. In any case, it may be cheaper than an person arrange bought on the open commercial center. Still, if you qualify for a premium assess credit due to your pay, you may pay a distant lower premium for your ACA Commercial center plan.

Read:TriCare: Understanding Military Health Insurance OptionsNote

Compared to the 18.2 million enlisted in an ACA arrange, as it were around 2.5 million individuals acquired person plans from off-Marketplace suppliers as of early 2023, concurring to the most later gauges from KFF (once the Kaiser Family Establishment). These plans incorporate short-term health protections and plans that don’t comply with the ACA due to grandfathering.

Even inside boss plans, contrasts exist. The normal representative at a private, for-profit firm contributes more for their healthcare scope (19%) than a open organization representative, who contributes 13%.

For the leftover portion of the taken a toll study, we’ll jump more profound into ACA and trade plans to learn more around how costs are affected by such variables as age and where you live.

How Much Does Health Protections Taken a toll by Age?

Member Age Monthly Cost

Age 18 $383.04

Age 21 $428.51

Age 27 $450.20

Read:Why Aetna Medicare Advantage Plans Are Worth ItAge 30 $487.19

Age 40 $548.29

Age 50 $766.43

Age 60 $1,163.90

Health protections acquired from the ACA intensely depends on a few factors. Age is a major figure, as protections companies are permitted to raise rates based on age. Youthful protections enrollees advantage from the least month to month health protections costs, no matter their health status. As you can see from the chart over, the month to month taken a toll for a 60-year-old is approximately twice that for a 40-year-old.

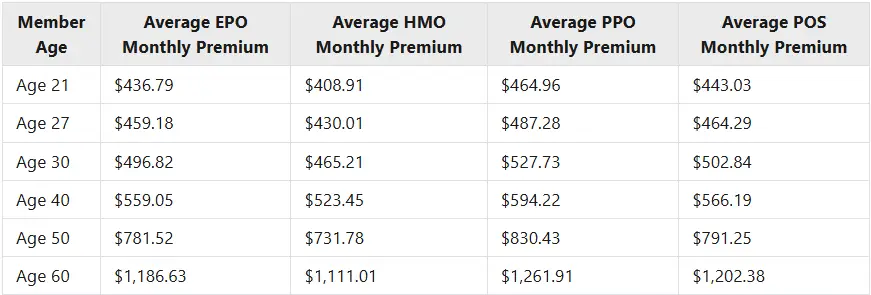

How Much Does Health Protections Fetched by Arrange Type?

Health protections cost moreover depend on the sort of protections you purchase. Plans with the slightest choice utilize HMOs (health upkeep organizations) and EPOs (select supplier organizations). For these plans, you fundamentally must work inside the insurer’s arrange and see a doctor who acts as a watchman for your care. Favored supplier organizations (PPOs) and point-of-service (POS) plans offer more choice—but taken a toll more, as well. If fetched control is your best need, an HMO gives the most reduced month to month pricing.

How Much Does Health Protections Fetched Per Company?

Health protections costs moreover shift by company. When we compared estimating from eight diverse companies over two ZIP codes in Florida and Texas, we found the taking after normal premiums.

Company / Monthly Cost

Ambetter $487.23

BCBS $479.63

Molina $505.32

Oscar $474.96

Aetna $454.76

UnitedHealthcare $522.74

Cigna $488.71

Kaiser Permanente $441.05

As you can see, Kaiser Permanente and Aetna advertised a few of the least premiums. The most noteworthy premiums were found at UnitedHealthcare and Cigna. But keep in intellect that your premium isn’t the as it were thought when you’re looking for reasonable health protections. Your deductible and the sum you have to shell out for copays or coinsurance too are components when you require to get care.

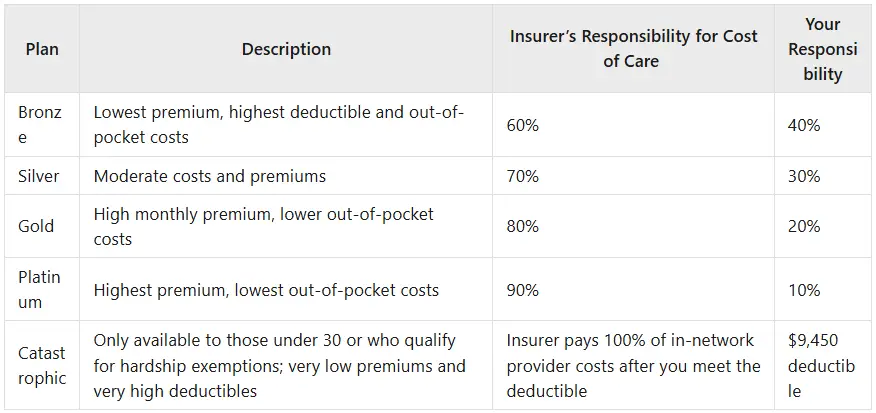

How Much Is Health Protections by Metal Tier?

The metal level of your arrange decides how you part healthcare costs with your protections company. In common, bronze and silver plans offer lower month to month premiums, but you’ll pay a higher rate of out-of-pocket healthcare costs on an continuous premise. Gold and platinum plans charge the most noteworthy premiums, but you won’t pay as much each month in copays and coinsurance.

Catastrophic plans are the slightest costly but are as it were accessible to candidates beneath 30 or individuals encountering extraordinary budgetary hardship. You’ll moreover have exceptionally tall deductibles and more restricted scope. These plans have the most reduced month to month premiums of all arrange sorts but don’t qualify for cost-sharing or premium diminishments.

Average Taken a toll of Health Protections by State

The most noteworthy premiums were found in Vermont, The frozen north, West Virginia, Wyoming, and Unused York. The most reduced premiums were found in Modern Hampshire, Minnesota, Maryland, Virginia, and Michigan.

States with premiums closest to the national normal of $477 were Texas, Wisconsin, Illinois, Modern Mexico, and California.

State / Average Benchmark Premium for a 40-Year-Old

Alabama $564

Alaska $889

Arizona $403

Arkansas $424

California $468

Colorado $451

Connecticut $661

Delaware $533

District of Columbia $532

Florida $489

Georgia $463

Hawaii $468

Idaho $417

Illinois $473

Indiana $399

Iowa $451

Kansas $486

Kentucky $431

Louisiana $563

Maine $515

Maryland $346

Massachusetts $419

Michigan $381

Minnesota $343

Missouri $501

Montana $504

Nebraska $570

Nevada $387

New Hampshire $335

New Jersey $461

New Mexico $471

New York $736

North Carolina $495

North Dakota $486

Ohio $435

Oklahoma $508

Oregon $488

Pennsylvania $445

Rhode Island $400

South Carolina $492

South Dakota $616

Tennessee $501

Texas $475

Utah $507

Vermont $950

Virginia $371

Washington $415

West Virginia $847

Wisconsin $476

Wyoming $821

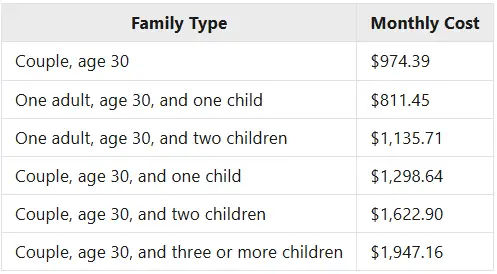

Average Taken a toll of Healthcare by Family Size

Your family estimate can moreover impact your month to month health protections charge. If your family incorporates children, you’ll pay less per child than you would per grown-up due to the age-related fetched scenarios depicted prior. If you have more than three children, you pay the same rate as if you had three children.

Factors Impacting Health Protections Costs

You can control a few health protections fetched factors—such as whether you smoke or if you purchase a bronze or platinum plan—but not others, such as your age. Health protections companies can no longer charge you more for pre-existing conditions gotten through the Commercial center or managers. In any case, certain grandfathered plans (sold some time recently ACA got to be compelling in Walk 2010) do not have to cover pre-existing conditions.

What components do companies presently consider when setting premiums?

Age

Age is a noteworthy figure in health protections costs. For ACA plans, ages are for the most part isolated into three bigger groups to calculate and set premiums:

- Children ages 0-20

- Adults ages 21-63

- Adults 64 and older

Premiums are slightest costly for those 20 and beneath, and most costly for those 64 and more seasoned.

Within the age 21 to 63 extend, premiums are set in one-year groups, but for the most part, premiums don’t begin expanding until age 25. You’ll discover the cheapest premiums at age 21. By age 46, premiums will be generally 1.5 times what they were at age 21. Premiums ordinarily twofold by age 53 and triple by age 64 and older.

Metal Tier

The Commercial center offers five sorts of plans with shifting cost-sharing alternatives and premiums. Be that as it may, not all plans are accessible from all guarantees or in all locations.

The plans are as takes after:

Tobacco Use

Your healthcare costs might be affected if you utilized any tobacco item or items four or more times per week inside the past six months. Your rates might be as much as 50% higher compared to somebody who doesn’t smoke.7 So, if a nonsmoker pays $500 month to month, you might pay $750.

Location

Each state is isolated into rating regions, regularly by province or bunches of districts. Guarantors utilize those rating zones to set premiums—all premiums in a specific rating zone are comparable, with alterations as it were based on age and smoking status. So, your protections premium seem increment or diminish depending on whether you move out of one province into another or from one state to another.

Family Size

In common, the levels of family estimate are as follows:

- Single: Protections for one person

- Couple: Two individuals who are married

- Single parent: Head of family (HoH) with one or more children matured 25 or younger

- Family: Couple with one or more children matured 25 or younger

For ACA plans, the single parent and family premiums are layered based on whether you have one, two, or three or more children beneath age 21. If you have four or more children, you’ll pay the same rate as somebody with three children. For person Commercial center plans , your pay and family estimate moreover influence your month to month appropriation.

Add up to Costs for Health Protections

When you include up your add up to health care costs, consider your protections premium furthermore any other continuous costs.8 Your add up to health protections costs might include up to nearly $20,000 per year for a family. Past the month to month premium, you’ll too pay for the following:

- Deductibles: You must spend this sum some time recently scope starts for your in-network restorative care and medications.

- Copayments and coinsurance: These allude to the rate or flat-rate dollar sum you pay for administrations such as PCP and master visits; crisis room treatment; and non specific, favored, and strength medications.

- Maximum out-of-pocket costs: This is the add up to you spend in a year (counting the two sums over) some time recently your protections starts covering all expenses.

- Add up the sums you think you’ll spend additionally premiums to gauge the add up to taken a toll of your health protections. In common, ACA plans will more often than not taken a toll more than a gather plan.

In 2024, your out-of-pocket costs (deductible, copayments, and coinsurance) can’t be more than $9,450 for one individual and $18,900 for a family for an ACA arrange. The out-of-pocket costs don’t incorporate your premiums or non-covered restorative administrations.

How to Purchase Health Insurance

Buying health protections depends on your life circumstance and accessible choices. The choices incorporate:

- Enrolling in an boss arrange through your work environment or your spouse’s

- Buying private health protections through an specialist or on the government Commercial center or your state’s marketplace

- Qualifying for Medicaid based on your salary and family status

- Applying for COBRA scope if you’ve as of late cleared out a work and you qualify

- Enrolling in Unique Medicare or a Medicare Advantage arrange, if eligible

Depending on your state and circumstances, you might enlist amid open enrollment or qualify for a specific enrollment period.

Alternatives to Health Insurance

Alternatives to health protections can incorporate essential care participations (paying a membership expense to get to administrations), healthcare sharing services, restorative markdown cards, and short-term health protections. In any case, numerous of these choices are not directed like other sorts of protections and so need fundamental shopper assurances.

Of course, going without health protections is another alternative—but it seem lead to genuine results, such as smashing restorative obligation or state-based charge punishments.

Frequently Inquired Questions (FAQs)

How Much Is Health Protections Without a Job?

You might qualify for free or low-cost Medicaid health protections or $0 premiums for a Commercial center health protections arrange based on your family wage, state of home, family status, incapacity, or other factors.9 About 20% of California health commercial center enrollees have $0 premiums. Health protections estimating is not based on your business status. The best health protections for unemployed individuals will have moo premiums, copays, and deductibles, and offer disastrous plans that may tide you over if you’re in a transitory bind.

How Much Is Health Protections for a Family of Four?

Much depends on how you get your health protections. If you have an employer-based arrange, the taken a toll of a family arrange, on normal, is $6,575 yearly, or around $548 a month. Compare this to $1,622.90 for an ACA arrange for a family of two grown-ups and two children. In any case, depending on their salary, families may moreover qualify for monetary offer assistance through the Commercial center. Or your children might qualify for Medicaid or the Children’s Health Protections Program (CHIP).

What Is the Most Costly Health Insurance?

On the Commercial center, a platinum arrange will include the most elevated month to month premiums. Be that as it may, you’ll pay less for doctor’s visits and medicines and have a lower deductible. The protections company will pay 90% for each secured restorative benefit, whereas you’ll pay 10%.

The Foot Line

Everyone needs therapeutic protections but the costs can shift broadly, depending on such variables as your age, family measure, where you live, and how you purchase your scope. Getting health protections through your boss is regularly the slightest costly alternative, unless you qualify for low-cost or no-premium protections programs advertised by the government or on the ACA Commercial center.

You have to wait 35 seconds.